Yeele/amazon (American flag), razihusin/Getty images (Cinema), Pngtree (Chinese flag)

(Downloadable link: https://drive.google.com/file/d/1cjS9uZs9sDFJsZKJl7P0Sp7ji8C3cJQX/view?usp=sharing)

While the unfruitful US-China trade war has been going on for a year now without reaching to a final deal, partnerships in the movie business between Hollywood and Chinese internet companies are strengthening.

Projected to be the largest theatrical market in the world in terms of total box office revenue, Chinese box office totaled 60.98 billion yuan ($8.87 billion) in 2018, with Hollywood films contributing a fourth of the total. Of the 13 top performing Hollywood box office hits from 2018 to April, 2019, 7 titles had something to do with Tencent or Alibaba, the two internet giants that not only dominate the internet in China, but also started to dabble in the global film industry in recent years.

(Top grossing Hollywood films in China from 2018 to April 2019, ranked by box office revenue. Source: Box Office Mojo)

Tencent Pictures is the film and television branch of Tencent that’s been responsible for marketing or financing numerous Hollywood projects, including ‘Aquaman’, ‘Venom’ and ‘Bumblebee’. These titles even performed better in China than in North America, and some analysts say that the box office success of ‘Venom’ in China could be due to Tencent Picture’s marketing campaign that went viral on Chinese social media.

‘Venom’ is a 2018 film produced by Columbia Pictures in association with Marvel Studios and Tencent Pictures. Tencent Pictures invested $33 million in the project, according to Deadline. The worldwide box office of the film counted $855 million, with China contributing more than a quarter. In 2018, the film is the second highest grossing import behind ‘Avengers 3’.

A promotional song featuring a Chinese girl idol band for ‘Venom’ reached more than 250 million people across all platforms, according to Yan Huang, a publicist at Tencent Pictures. “The alternative combination of the sweet girl and the dark hero promoted strong interests from female audiences,” she said.

“The core audience for ‘Venom’ is the superhero movie fans and science fiction and action movie fans. But any film that passes 100 million yuan ($15 million) in box office would depend not only on core audience’s support, but also on a well-distributed audience,” said Yan Huang. “Together with Sony, we used big data to to clarify the audience by stratifying the audience. At the same time, during the marketing campaign, we partnered with Maoyan (a ticketing app) to analyze feedback based on the materials, and to accurately depict the core and peripheral audiences step by step.”

But another reason why ‘Venom’ did well in China could be attributed to weaker competition during the same release window. Because of a government crackdown on tax evasions from film companies, many domestic productions have been stalled.

“Many A-list stars now have to take projects that have less exposure. Film and television projects are being pushed back because of many reasons, such as tightening censorship, and insufficient investment,” said Star Chen, a film reporter at Yitiao, a Chinese lifestyle magazine.

Some refer to 2018 as “the winter of the movie business”, a phrase borrowed from HBO’s hit series Game of Thrones that’s also immensely popular in China, made possible by Tencent Video’s partnership with HBO as the official platform to stream the series (nude and extreme violence scenes are cut), in addition to free pirated downloads.

Before the release of ‘Venom’, China’s box office revenue per day has sunken to below 100 million yuan ($15 million) for weeks. ‘Venom’ was the highest grossing film during its first week of release and eventually received theatrical extensions to boost up ticket sales.

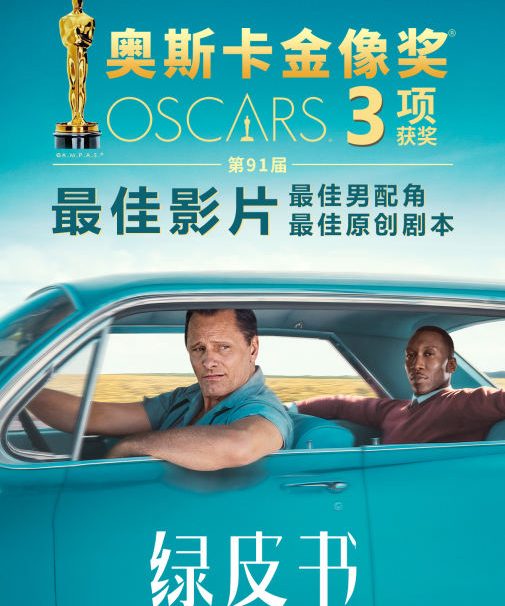

Alibaba Pictures, subsidiary of Alibaba Group, on the other hand, has been investing in Hollywood films such as ‘Green Book’ and ‘Bohemian Rhapsody’. ‘Green Book’ made $70 million in China, a figure previously unheard of for Oscars Best Picture winners that were released in China.

Whether it’s Alibaba or Tencent, they all have the monetary incentive for their co-financed Hollywood films to do well in China.

“Both sides are basically benefitting,” USC professor Stanley Rosen said. Rosen is an expert in Chinese politics, film and the relationship between China and Hollywood. “China definitely needs Hollywood films, because if China box office would be the largest in the world, they can’t do that with just domestic films. Hollywood films are popular, and Hollywood talent does a lot of collaborative work with China, so they need that kind of expertise in storytelling, visual effects, and so on. So they can learn a lot from Hollywood, and Hollywood could benefit from Chinese investment and the Chinese market.”

In the last five years, Chinese investment in Hollywood has been steadily growing until a crackdown on overseas investment. In 2016, Chinese real estate and theater chain mogul Wang Jianlin’s Wanda Group acquired Legendary Entertainment for $3.5 billion and took a majority stake in AMC in 2012 for $2.5 billion.

But after the crackdown, many high stake investment deals have gone sour. Wanda has scrapped its proposed $1 billion takeover of Dick Clark Productions and trimmed its stake in AMC from 60 percent to 38 percent. China’s Huahua Media’s $1 billion financing deal with Paramount Studio never happened as well.

It’s likely that both sides contributed to this disruption: U.S. lawmakers pushed for increased regulatory scrutiny of Chinese investment in Hollywood, and the Chinese government feared that too much capital was funneling offshore.

Amid the tensions of an on-going trade war, the five-year film pact between the two nations is unlikely to be brought to the table again until a trade resolution could be reached, according to Rosen. The current film pact limits imported films to a number of 34, although it has gone beyond that contractual number last year to save the underperforming market. For example, ‘Aquaman’ opened two weeks prior to North America to record audiences, despite its release window being a traditional black-out period intended for preserving domestic productions. Moreover, Hollywood studios take in 25 percent of the revenue that their films generated in China.

But the ultimate goal of Tencent Pictures is to tell Chinese stories, and to export Chinese cultures and values globally.

“We also see that as globalization progresses, Hollywood’s demand for multiracial, diversified content is also rising, bringing more opportunities for the integration and inclusion of world cinema. There are also cool modern stories in China. There are countless new themes on Tencent’s animation, games, literature and other platforms. There are sci-fi, superheroes, suspenseful actions and other stories that adapt to Hollywood’s hard theme, as well as stories with emotional and delicate values.” said Yan Huang. “Tencent Pictures hopes to act as a bridge in the globalization trend, and bring more Chinese stories to Hollywood through our investment and incubation.”

One recent example is ‘The Wandering Earth’. Co-Produced by Tencent Pictures, Alibaba Pictures, and others, the film grossed $690 million in China, but only $5.9 million in North America. Netflix acquired the streaming rights of ‘The Wandering Earth’ in February, and it’s available starting from April 30, 2019. Netflix has previously acquired streaming rights of several Chinese-language TV dramas. Although the service is not available in mainland China, it’s available in other regions and nations that have Chinese audiences.

“Netflix is committed to providing entertainment lovers with access to a wide variety of global content. With its high-quality production and story-telling, we believe that ‘The Wandering Earth’ will be loved by Sci-Fi fans around the world.” said Jerry Zhang, Manager of Content Acquisition at Netflix.

However, Rosen expressed his concerns, as the production of films in China is still tightly controlled by the State propaganda department.

“Chinese films do not travel well,” Rosen said. “In part because of the nature of very structural obstacles, which make it difficult: language issues, film like ‘The Wandering Earth’, you spend so much time reading the subtitles you can’t see what’s going on in the screen. But China is also its own worst enemy. A lot of things going on in China, which they just don’t explain, and because of that, people think the worst. They still will have problems even in the best situation, because only Hollywood has a real worldwide presence in film but China does a lot of things to self-destruct itself.”