CJ Haddad eagerly studied online tutorials to learn how to do her own gel manicures.

Haddad, a University of Southern California (USC) junior frequented salons as a teenager and enjoyed having her nails done, but the increasingly high price point of manicures pushed her to make a switch.

“When I started handling most of my own budget as an adult, it just didn’t really feel like an expense that was worth it, even though I wanted to have pretty nails.”

Haddad’s new Do-It-Yourself, or DIY, nail routine is a tiny part of the $10.9 billion global nail care market in the U.S. and the growing at-home nail product industry. Economic uncertainty and increasing inflation have driven many consumers to look for creative ways to cut costs.

The U.S. inflation rate started climbing in 2020 and has remained stubbornly high throughout 2023 and 2024. This has influenced consumers to become less likely to splurge or buy luxurious items and to even lose brand loyalty.

According to consumer psychologist, Dr. Cathrine Jansson-Boyd, the types of purchases people make while under financial stress will change to what they deem affordable. “When we experience some sort of slump in terms of finances, we tend to still want a bit of a treat. If you can’t afford the usual luxuries, you will think about something that feels a bit special, but isn’t very expensive,” she said.

When it comes to salon-style nail care, those who regularly budget for nail products and salon visits are a demographic more likely to be interested in changing their routine to save money. These consumers value this type of service, but for some, the increasing cost and fear of a recession are becoming an even stronger force. In the U.S., rising inflation is a big influence on the growing DIY market.

Additionally, Jansson-Boyd says that when people think they’re getting a good price, the part of the brain associated with rewards is activated. “It gives you more of a reward, as a consequence of having spent less and therefore you get more happiness out of it,” she said. These feelings of satisfaction when purchasing supplies and performing the DIY salon process can support and promote future buying decisions. Consumers can experience greater psychological satisfaction with themselves, while also saving money.

While the economy may be resilient, inflation is what people look to, according to Ratika Narag, an associate professor of economics at USC. She points out that the beauty industry has been very resilient even though many are trying to spend less.

She cited the McKinsey Report’s prediction that the beauty product industry will be worth $580 billion by 2027.

For USC sophomore Tammy Premchan, learning a new skill was the most cost-effective solution to continue having Gel-X nails, a type of gel nail extension. While she didn’t want to pay full price, she also didn’t want to give up the luxury of a manicure.

“Nails are almost like an accessory in a way. They really do a lot. If I have longer nails, people’s eyes gravitate towards them,” she said.

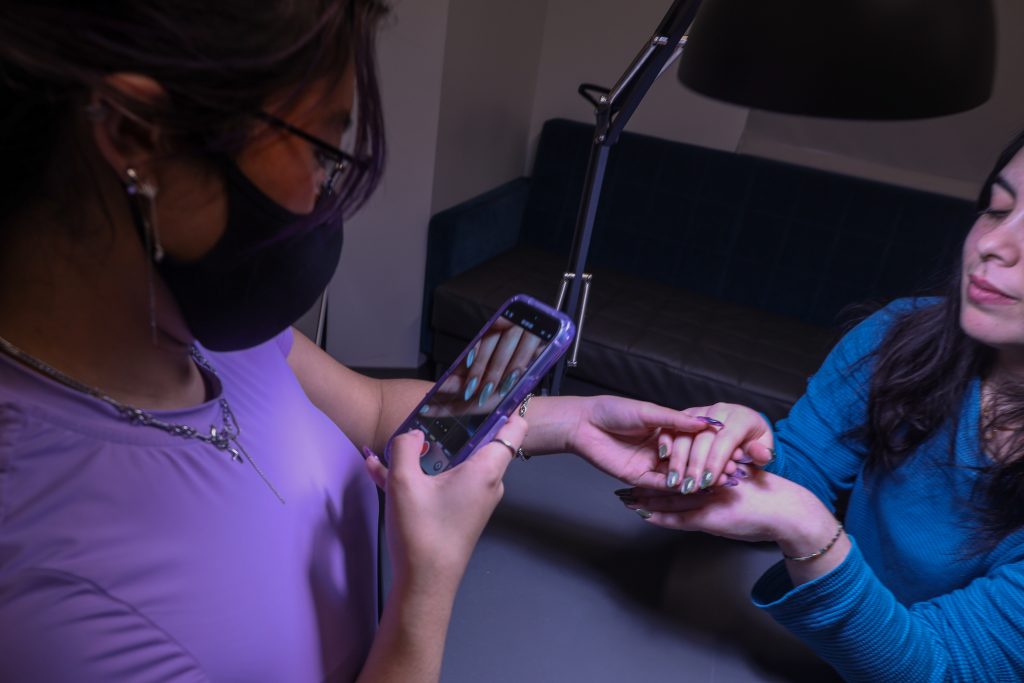

Premchan began learning how to do her own nails in February 2023. Practice makes perfect, and soon her friends were asking her for budget-friendly manicures. She decided to turn her new skill into a small business and created “Nails by Tammy.”

She now runs an Instagram nail account (@Tammy.X.Nails) with over 200 followers, which doubles as her website. Customers can book services through direct messaging and find pricing on Instagram story highlights. She operates the actual nail appointments in a USC study room.

Premchan’s customer and friend, Mia Chavez, paints her nails once a week. She decided to invest in a Gel-X manicure that will last longer but cost half of what her local salon charges.

“I couldn’t really justify spending that much on my nails, but because Tammy is a close friend of mine and I trust her, I’d rather pay my friend for the service,” she said.

At-home nail service businesses, like “Nails by Tammy,” have seen an increase in demand by 32% during the COVID-19 pandemic.

According to Narag, a struggle for many businesses is overhead costs. They not only need to pay labor, but also rent, water, electricity, and supplies. During an economic downturn, these expenses can be the breaking point for small businesses.

According to the Nineteen 85 Nail Bar, gel manicures in Los Angeles can cost $100 or more. Since Tammy Premchen’s only operating costs are her materials, “Nails by Tammy” can charge $35 for gel-manicured nails and still turn a profit. This small cottage-industry business relies on creative cost-saving features, including using a USC study room as a makeshift salon for manicures.

Her lower price point results in higher demand, making her business a prime example of the “lipstick index,” an economic theory, created by Leonard Lauder, the chairman of the board of Estee Lauder. This theory helps explain why cosmetic sales increased during the 2008 Great Recession.

When consumers face financial challenges or hardships, they do not usually buy a lot of costly luxury items. But, they may convince themselves to buy smaller things they desire. Lipstick, as the theory goes, is a small item that may not cost a lot, but can allow the consumer to feel better for having it.

Affordable luxuries (i.e., lipstick), or, in this case, salon-level nail care products, help consumers feel more like themselves, which can ease the stress of difficult financial situations, explains Narag.

“If it’s not going to cost that much money and it’s still something they like to do, people will spend money on things that they think are part of their identity. It makes them who they are,” she said.

On a smaller scale, individuals’ DIY approaches and businesses like Premchan’s are closing the gap between consumers’ financial insecurity and increasing salon costs. A manicure is a small luxury that people value but that is also becoming less accessible.

The Impact of COVID-19

The COVID-19 pandemic influenced many consumers to change their nail practices.

The pandemic shut down everything, making salons inaccessible. Nail salon devotees had to learn to DIY or go without.

Serendipitously, nail companies Manucurist and ManiMe launched their businesses in 2019. They both act as an alternative to nail salons. They saw great success during the pandemic when DIY was the only option.

“People are choosing to go towards more DIY nail products because the cost of getting a manicure is very expensive. And, especially during COVID, a lot of people wanted to keep getting their nails done and so, they looked at alternatives,” said Lexi Lynn, a marketing project manager for Manucurist.

Manucurist makes a gel polish that can be removed like a traditional nail polish. It is one of the many growing DIY nail companies. Even after COVID, when salons re-opened, some consumers chose to keep saving money and continued to do their own nails.

These companies have remained popular, while the market for beauty salons has still not reached what it was before the pandemic.

“Our company is positioned in the perfect middle space where it does allow people to have this kind of luxury, but it isn’t so expensive that it’s out of reach,” said Lynn.

These “middle spaces” are becoming more and more sought after. In 2021, almost a third of shoppers said they were switching to DIY nail application.

Downtown Los Angeles resident Kathy Tsaur, was looking for a way to do her nails during the pandemic. She started doing her own Gel-X with a co-worker as a hobby and has continued the DIY practice because of its affordability. The Gel-X kit she uses costs about the same price as what she was paying for one monthly manicure.

“I definitely noticed that, especially with tips, just a basic Gel X, one color can cost $130 to $150. And that’s just really not sustainable,” said Tsaur.

Tsaur chose a more difficult self-done manicure route. She typically does simple glazed or French-styled nails, but for special events adds charms and paints complex designs. She enjoys customizing her nails herself and didn’t want to give up the feeling of having manicured nails.

“It just makes you feel put together and it’s a fun part of my routine that I enjoy,” said Tsaur.

For nail aficionados who prefer a less time-consuming DIY solution, nail sticker company ManiMe aims to make simpler and less expensive ways for customers to have styled nails.

Esteban Restrepo Tabares, the CEO and founding member of ManiMe, saw the brand grow during the COVID-19 pandemic. Stickers were one of the solutions for people preferring to have their nails done while quarantined.

“We’ve seen a lot of reviews and feedback from the customers saying that they will not go back to the salon again because it’s definitely a cheaper solution,” said Tabares.

ManiMe sells a variety of styled stick-on gel manicures that cost around $10. However, one of the downfalls of ready-to-go manicures is they can’t keep up with trends at the same pace as salons.

“There was a desire for super long nails, super crazy gels, with a lot of details, and 3D things in their manicures. People are now paying $200 to go and do these crazy and beautiful nails that are really hard to achieve at home” said Tabares.

ManiMe noticed two main markets for people who enjoy having designed nails. The first enjoys being on trend, often choosing complicated nail designs. While the second is looking for something convenient and affordable. This second group has been underserved and is their main demographic.

Now, DIY companies are on the rise and can cater to customers who prefer spending less. Just the nail sticker industry is growing and is expected to keep increasing until 2032.

Nail care companies provide the delicate styles consumers are used to but at a significantly lower price point. Although they cannot do every style or trend immediately, that is not a factor for every demographic. For some, saving time and money is more important. They would rather pay for a less expensive product than more for a service.

How do Los Angeles-based nail salons feel this impact?

Los Angeles County is the county with the most nail salon workers in the U.S. It makes up 4% of nail salon workers. Here is how some of the most popular salons (based on Yelp) have seen changes.

The nail salon industry may be slowing down, but to those who can afford it, there are benefits. Salons have been found to have positive psychological effects and leave customers with a sense of relaxation and enjoyment.

Premchan saw the power of in-person services firsthand.

The future

The nail industry is growing rapidly. In 2021, the global nail care market was worth more than $19 billion and is predicted to increase with a compound annual growth rate (CAGR) of 5.2% from 2022 to 2030.

In the nail industry (including salons), nail polish sales account for more than half of total sales, while the “artificial nails and accessories” segment is expected to grow at the fastest rate from 2022 to 2030. Younger nail consumers are pushing the market to include longer, flashy products, such as press-on nails. These “accessories” or DIY products are growing in popularity partially because of their lower price point.

Inflation has risen and necessary goods, like food, have seen increased prices. Narag explains that the inflation rate makes many consumers doubt the economy and become more suspicious that there will be a recession. “Even though we might not enter into a recession, we’re not sure. The stock market might be booming, but the economy is different and inflation has impacted people a lot,” she said.

This distrust in the economy influences the way people spend their money. More of peoples’ incomes are consumed by necessities like food and housing, and less by luxuries like nail salons. Beauty product purchases can be impacted by available income so when people become wary of an economic downturn, they may choose to spend less. But also, not nothing.

Painting one’s own nails is not a new phenomenon, but as fashion trends are influenced by economic cycles, DIY products continue to sprout and grow. Products designed and sold by new DIY companies, or pop-up services offered by community members are less expensive for consumers. These innovations have become highly desired alternatives to expensive salons.